Outpatient services continues to be one of the biggest health care cost drivers

Health care costs in Colorado and across the nation are increasing at a rapid pace, continuing to make care unaffordable for many people. A key to addressing health care affordability is understanding where health care dollars are going and what types of care are driving the highest spending to identify where cost-saving opportunities exist.

There are a number of factors that contribute to variation in health care costs, including wasteful spending, frequency at which people visit a provider, and the prices for various services. Multiple community initiatives and state-led efforts are underway in Colorado to curb spending in a number of areas identified as drivers of increasing health care costs, including prescription drug costs, out of network services, and enhancing primary care.

CIVHC’s Affordability Dashboard, released in March 2022, is a tool that helps identify how these pieces fit into the larger health care puzzle of spending and costs in Colorado. Using the Affordability Dashboard, policy makers, payers, providers, state agencies, and other community stakeholders can monitor trends in various health care categories and develop strategies to reduce costs.

Currently, the Affordability Dashboard includes Cost of Care information, which monitors spending trends and identifies the health care categories that are the biggest cost drivers. The analysis is broken into five service categories: professional, outpatient, inpatient, pharmacy, long term care and dental.

Outpatient services drive more than $5.8 billion in spending annually across all payers in the Colorado All Payer Claims Database (CO APCD), equating to 22% of total health care spending in Colorado. However, outpatient services encompass a wide variety of sub categories of spending, so the report also goes deeper into this high-spend category to further breakdown and understand cost and spending trends.

Defining Outpatient Services

The high-level definition of outpatient services used for the analysis is:

“Services for ambulatory surgery, observation stays, and emergency department visits that did not result in an overnight hospital stay. Costs displayed include patient and health plan patients for facility services only, and do not include professional payments which may occur for the same visit.”

Within the category, claims were broken down into an additional 13 subgroups to capture the variety of outpatient services.

Further explanation of each category can be found in the Cost of Care Analysis Methodology and Cost of Care Definitions.

Further explanation of each category can be found in the Cost of Care Analysis Methodology and Cost of Care Definitions.

The outpatient categories provide users with a more precise understanding of the services that are driving the highest spend and how it’s changing over time. The analysis shows that the top outpatient services by spending are surgery, emergency room visits, prescription drugs, and “other” which includes services such as dialysis, chemotherapy, cardiac catheterization, and treatment room costs.

The subcategories also illuminate areas that are important to fully understanding outpatient spending and highlights categories that may otherwise be overlooked such as lab costs, prescription drugs administered in an outpatient setting, home health services, and facility imaging fees.

The Rural and Urban Outpatient Cost Divide

By showing detailed spending trends for high-cost outpatient services, the Cost of Care analysis can help stakeholders identify where to focus efforts to curb rising costs.

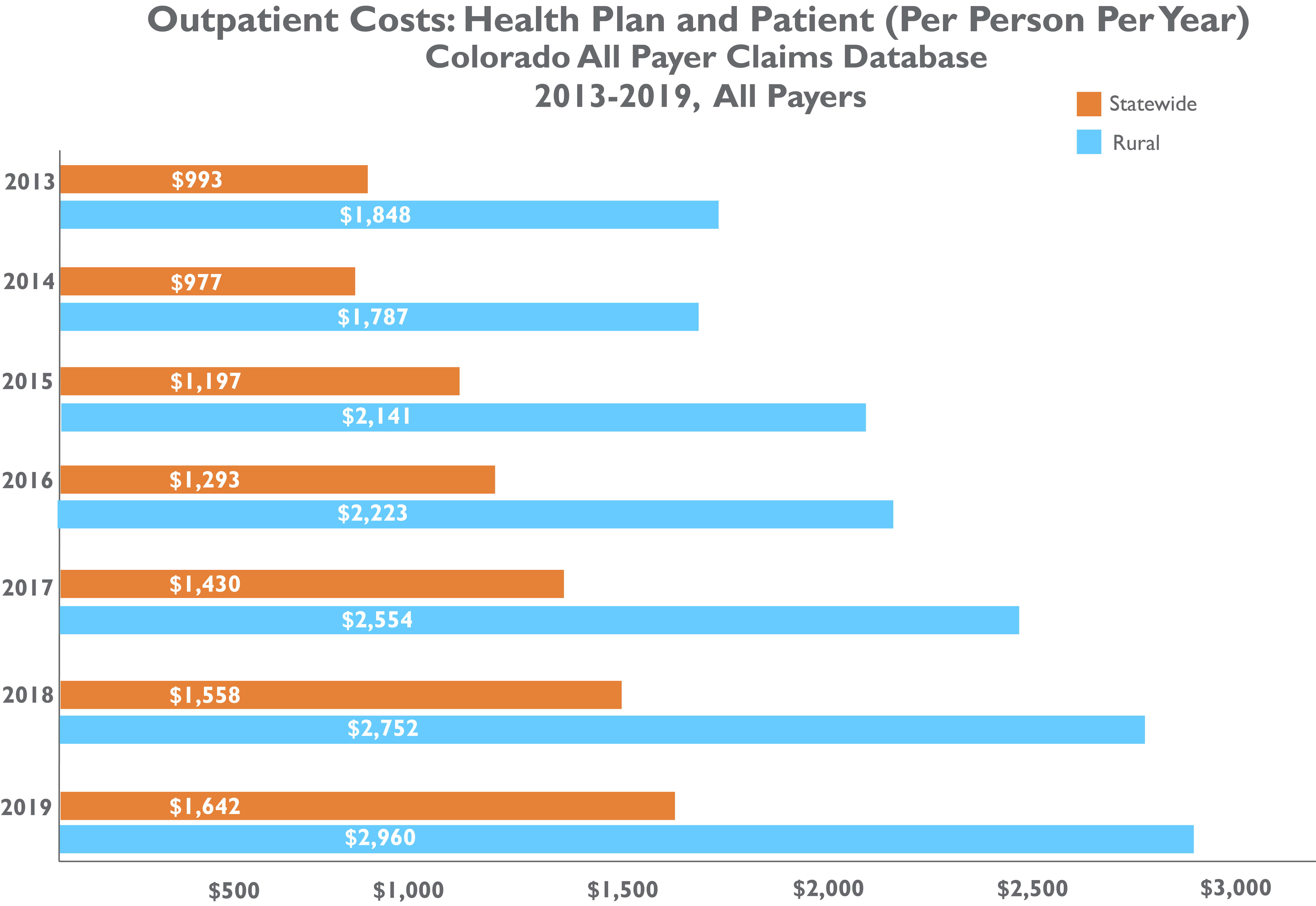

CIVHC’s Community Dashboard, recently updated with data through 2020, shows that outpatient costs are continuing to rise, and increased by 42% overall from 2013-2019 across all payers. That is the second highest increase next to pharmacy costs which rose 87% in that same time frame.

CIVHC’s most recent Medicare Reference-Based Pricing analysis, in partnership with RAND Corporation, showed that Colorado’s comparative outpatient payments are significantly higher than the national average (267%) and over three times higher than Medicare rates (312%), making outpatient services in Colorado as among the most expensive in the country.

Digging deeper into outpatient service cost data in the Community Dashboard shows that there is inequity across regions. In particular, people living in rural Colorado face significantly higher outpatient costs:

Why Are Costs Rising?

The continued rise in outpatient costs in Colorado can be attributed to a number of possible reasons, the most significant of which might be the declining number of freestanding, independent private practices and clinics. Freestanding clinics are facilities operated by a provider not affiliated with or owned by a hospital or health system. However, increasingly, hospitals are buying or partnering with freestanding clinics and providers which allows them to include a hospital facility fee to physician and dentist services, adding additional fees that patients and health insurance plans are responsible for.

With freestanding clinics becoming few and far between, facility fees are playing a significant role in driving prices upward.

In a study that demonstrated the potential of increased utilization of freestanding clinics, CIVHC Change Agent The Colorado Purchasing Alliance asked CIVHC to use CO APCD data to investigate cost saving opportunities with outpatient procedures. The study found that, out of the 10 highest volume services used by the TCPA population, there was an average of 44% savings moving from a hospital to a free-standing facility and potential savings of $5.7 million over two years if employees were incentivized and educated to visit the lowest care facility types more frequently.

What Can Be Done?

One way to approach reducing facility fees is through policy. The National Academy for State Health Policy (NASHP) developed a model act – State Legislation to Prohibit Unwarranted Facility Fees – that can use to develop policy to limit inappropriate facility fees. The model bars facility fees from practices and clinics located more than 250 feet from a hospital and prohibits facility fees for typical outpatient services, even if performed at a hospital setting.

CIVHC has a working relationship with NASHP and provided data to help them evaluate the impact of provider mergers on facility fees in Colorado. Using NASHP’s model legislation, states can develop their own policy to curb facility fees and require more transparency for consumers.